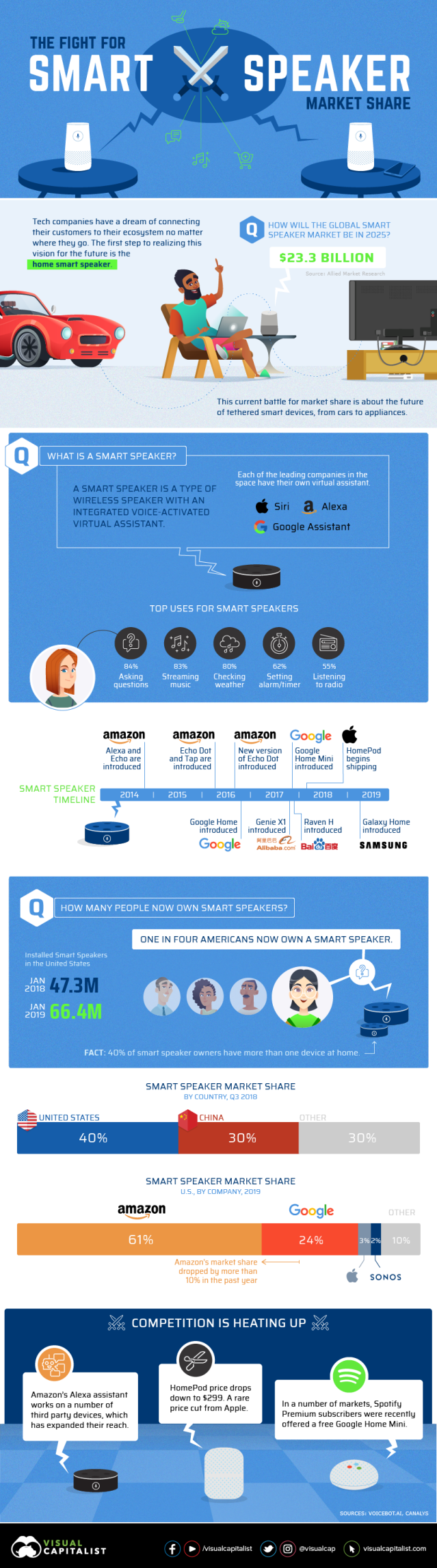

Tech companies are betting that the future of personal computing will be driven by the sound of your voice.

If they’re right, this early stage of smart speaker adoption will have a massive impact on future profits. Switching smartphone brands is relatively straightforward, but switching an entire voice assistant ecosystem? That’s not quite as easy.

“Voice Assistants like Siri and Alexa will transform behavior inside the home. At the center of that behavior is a smart speaker, serving as the hub of a connected lifestyle.”– Andy Chambers, Vice President of Connected Home, Assurant

Today’s infographic is an overview of the rapidly expanding smart speaker market, and how the major players in the space are competing for critical early market share.

Here’s a look at U.S. smart speaker market share by device:

Source: voicebot.ai

The Fight is Heating Up

Companies are responding to Amazon’s market dominance in different ways.

Apple recently dropped the price of its HomePod smart speaker to $299, a rare price cut for a company that is used to people lining up to buy its products. Unlike its competitors, Apple can’t go all-in on using the device as a “loss leader” to support advertising or e-commerce. HomePod is positioned as a more premium product, but the price will be a sticking point for many.

Google, on the other hand, is taking a drastically different approach. The company released the Google Home Mini as a cost-effective entry point for consumers looking to try out a voice-directed device.

As well, Google partnered with Spotify to offer Home Minis as a free promotion for Spotify Premium customers. Spotify’s premium userbase is nearly 90 million, so if even a fraction of users take the free offer, a massive influx of Google smart speakers will enter the market.

What’s Next? It’s Hard to Say

With the promise of future connected home profits on the line, it’s hard to say what lengths companies will go to outmaneuver each other. One thing is clear though, the overall smart speaker market is still in the midst of a major growth cycle, and we’re just seeing the beginning of what’s possible with voice-directed devices.

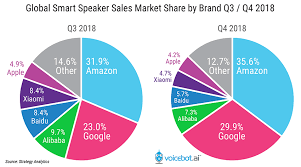

Amazon’s global smart speaker sales share rose in Q4 2018 to 35.6% compared to 31.9% in Q3 2018. Source: Voicebot.ai

Amazon increased its lead in global smart speaker sales in Q4 2018 according to research firm Strategy Analytics. The Amazon Echo product line accounted for 35.6% of total global smart speaker sales in the fourth quarter up from 31.9% in Q3 2018. Google Home devices were second in the category in both quarters and rose from just 23% to 29.9% between the third and fourth quarters. Meanwhile, Apple HomePod sales fell from 4.9% to 4.2% of sales unit volume.